While all investing carries some risk, that doesn’t mean all risk is created equal. Learn how to optimize your portfolio weighting for the best risk-adjusted returns using modern portfolio theory and the Sharpe ratio.

Modern Portfolio Theory

To calculate the most efficient crypto portfolio, we will utilize aspects of Modern Portfolio Theory (MPT). The theory assumes that an investor is risk-averse and is looking to find the optimum ratio between theoretical gains and assumed risk. MPT does this by taking a batch of assets and calculating the best weighting for each using historical data. From this point, we can adjust weightings to increase or decrease theoretical returns against the volatility of each asset.

Riskier investments often have the potential for greater returns. Thus, modern portfolio theory seeks to create a weighted portfolio that finds the highest theoretical returns for the least amount of risk.

For example, a portfolio weighting could yield a 90% return based on historical data but have an implied risk (as measured by volatility) of 0.8. Another weighting could lead to only 70% returns but have a much lower risk, making it a better risk-adjusted investment. This ratio between expected return and risk is more commonly known as the Sharpe ratio.

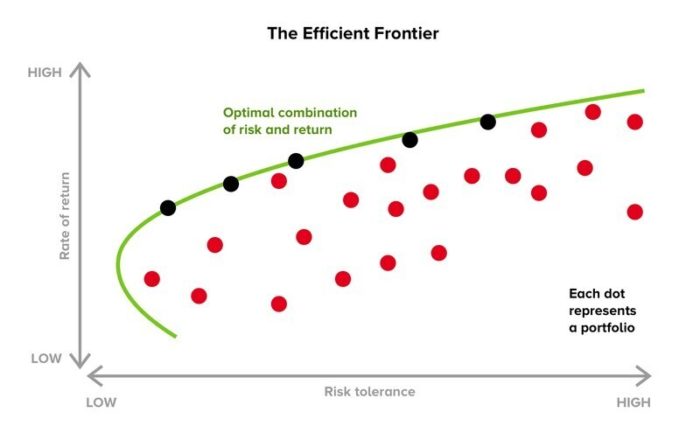

The higher an asset, or group of assets, the higher its theoretical returns are per unit of risk. By experimenting with different asset weightings, we can find optimum portfolio compositions depending on how much risk an investor is willing to take. We can use a Monte-Carlo approach to generate an “efficient frontier” of portfolio compositions that maximizes risk-adjusted returns.

Source: DataDrivenInvestor

Each dot on the graph represents a hypothetical portfolio. Dots in black on the top edge of the plot are part of the efficient frontier. These portfolios have the best risk-adjusted returns, meaning that an investor is not taking on additional risk without the likelihood of optimum returns.

The Sharpe Ratio and Crypto Portfolios

While modern portfolio theory and the Sharpe ratio were originally designed for use in traditional financial markets, investors can also use them to optimize a crypto portfolio.

However, calculating an accurate Sharpe ratio relies heavily on historical price data. To generate a good Sharpe ratio for portfolio allocation of a given crypto asset, we need data on its performance during a full bull/bear cycle to assess its volatility and the subsequent risk of holding it.

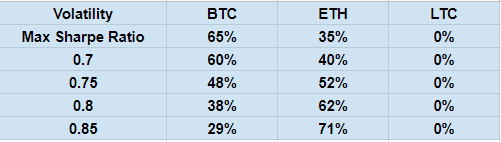

Unfortunately, the crypto space is both nascent and fast-moving, meaning that few assets with enough historical data are eligible for consideration. This analysis will use a portfolio of Bitcoin, Ethereum, and Litecoin to demonstrate the best risk-adjusted returns as these assets have the highest market capitalization with the most historical data. Using these three assets, the approximate best allocation for maximizing risk-adjusted returns comes out at 65% Bitcoin, 35% Ethereum, and 0% Litecoin.

However, moving along the efficient frontier will display efficient portfolios with higher risk-adjusted returns. Generally, riskier portfolios on the frontier will substitute Bitcoin for Ethereum. Historical data indicates that Ethereum can generate higher returns than Bitcoin but is also more susceptible to large drawdowns, increasing its volatility and, therefore, the risk of holding it.

Source: Benjamin Cowen

Now we’ve examined how modern portfolio theory and the Sharpe Ratio can help us achieve the best risk-adjusted returns, let’s look at examples of low, medium, and high-risk portfolios.

Low-Risk

The lowest risk crypto portfolio with the highest returns follows the efficient frontier as described previously. Using current historical data, low-risk investors should allocate around 65% to Bitcoin and 35% to Ethereum to create the safest portfolio with the most upside potential. Investors wanting to increase their risk-adjusted returns can try allocating less to Bitcoin and more to Ethereum. At this point, all other crypto assets are either too risky or have similar risk profiles but worse historical returns than Bitcoin and Ethereum, such as Litecoin.

Medium-Risk

A medium-risk portfolio will still use the efficient frontier to maximize risk-adjusted returns but moves away from a high Bitcoin allocation. 10% Bitcoin, 89% Ethereum, and possibly 1% Litecoin would be one way to achieve a medium-risk portfolio. The high proportion of Ethereum will increase theoretical returns but also implied volatility. Additionally, a small allocation of Litecoin may help yield a higher return in the scenario where it experiences significant upward price divergence.

High-Risk

This is where things get interesting. As mentioned previously, when calculating lower-risk portfolios, we only want to use assets that have price data going back several years. However, there is still some merit to looking at the Sharpe ratios for newer crypto assets, as long as we understand that doing so exposes an investor to a lot more risk.

For a higher-risk portfolio, an investor can substitute an increasing amount of Ethereum for other crypto assets. To help identify candidates for a high-risk allocation, we can look at the one-year Sharpe ratios of other crypto assets and see how they compare to Bitcoin and Ethereum.

Source: Messari

Source: Messari

When choosing riskier assets for a portfolio, anything with a Sharpe ratio higher than Bitcoin and Ethereum is a potential candidate. Within the top 10 crypto assets by market capitalization, Solana and Terra have ratios of 3.37 and 3.25, respectively, with Cardano coming in third at 2.85.

Because Solana, Terra, and Cardano have one-year Sharpe ratios higher than Ethereum, they could be good riskier assets to pick based purely on the historical data. However, it is important to note that other factors are important when deciding whether to invest in an asset. Things such as the project fundamentals, time since launch, and whether or not the asset price looks overextended should all be considered when choosing an investment.

Like before, a portfolio will become riskier but potentially yield higher returns the more Ethereum is substituted for these newer, riskier assets.

Whether you’re looking for the best low-risk allocation or willing to dive into some riskier bets, you’ll need to find somewhere to build your portfolio. This is where Phemex comes in. You can purchase all of the assets mentioned in this feature plus many more. Moreover, the platform’s low fees and excellent support services make for a great choice. For those not ready to jump in just yet, Phemex offers simulated crypto trading where users can learn and test different trading strategies, risk-free.

For more advanced users, Phemex offers perpetual contract trading on all crypto assets and inverse perpetuals on Bitcoin. By depositing and trading on Phemex, users can earn up to $100 and receive additional fee discounts and bonuses by referring friends. For more information, check out the official Phemex website .

Source: cryptobriefing.com