Bitcoin Cash targeted its 50% Fibonacci level ($1,075.5) to enable swift recovery on the charts while Ethereum Classic threatened a 30% fall if it failed to hold on to the $65-support. Finally, Filecoin’s comeback fared better than most alts, but its gains were limited to the $95-resistance level.

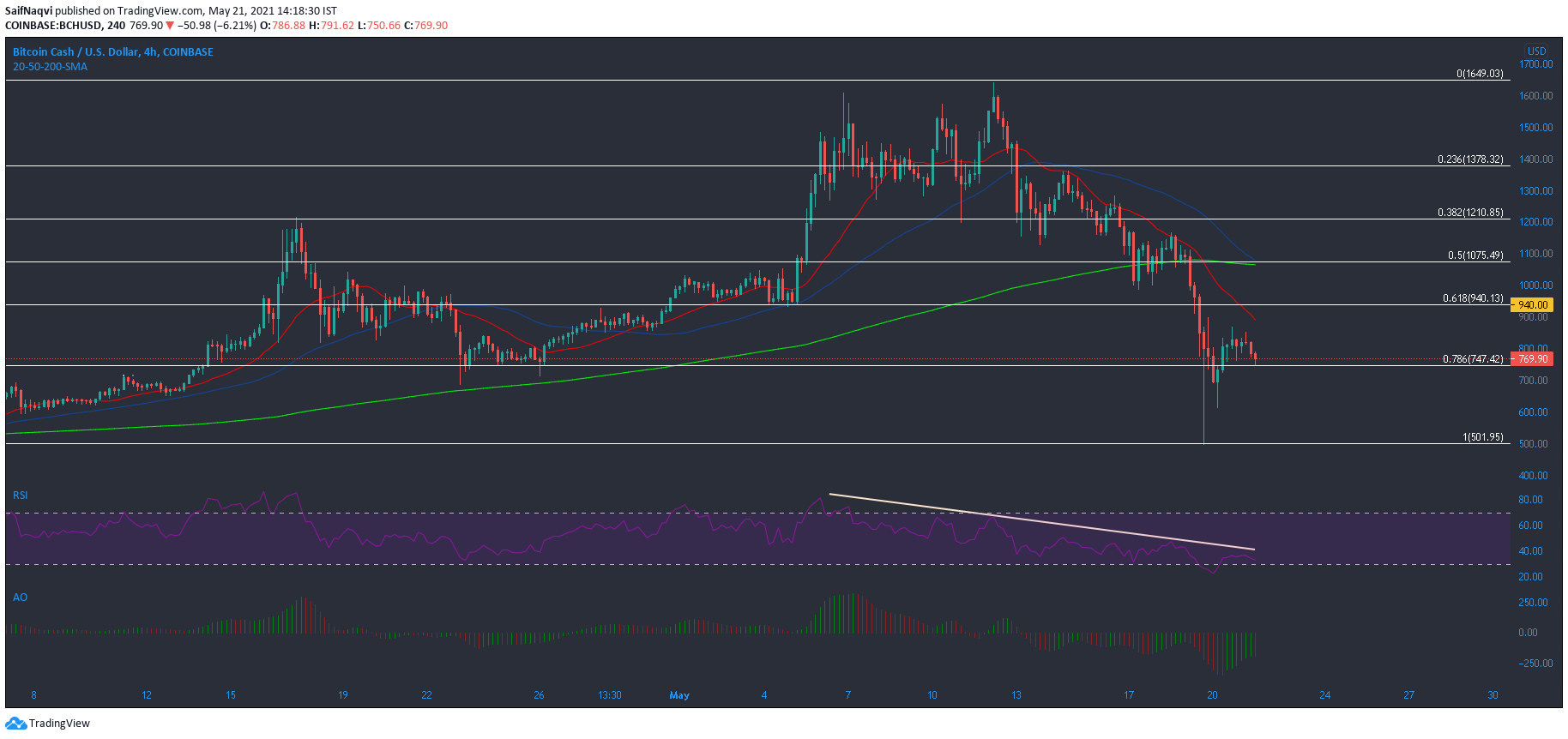

Bitcoin Cash [BCH]

Bitcoin Cash’s bearish turnaround epitomized the change in fortunes of the broader cryptocurrency market. On 12 May, BCH formed a local peak at $1,642, but fell as low as $500 post the crypto sell-off. This represented a staggering loss of over 70% in just eight days. While BCH was able to recover above its 78.6% Fibonacci level ($747.4), the candlesticks remained below their 20-SMA (red), 50-SMA (yellow), and 200-SMA (green), at the time of writing.

With capital slowly moving back into crypto, recovery for most alts is expected to be a gradual process and BCH was no exception.

A key resistance zone lay at the 50% Fibonacci level ($1,075.5) and close to the 200-SMA. Reclaiming this area could trigger a price hike moving forward. Lower highs on the RSI pointed to a weakening for BCH even prior to the broader market pullback. A fall below $747 could open up some long opportunities. Some bullish momentum was visible on the Awesome Oscillator, but not enough to warrant a breakout just yet.

Ethereum Classic [ETC]

On the 4-hour charts, Ethereum Classic was at a crossroads between its 20-SMA (red) and 200-SMA (green). The press time level was of significance as it also clashed with the 50-SMA on the hourly and daily timeframes as well. The threat of a breakdown was just around the corner, one that could trigger a 30% retracement towards the $47.8-support.

If the present support level is maintained, some sideways movement can be expected over the coming sessions. If ETH manages to claw back above $3,000, a corresponding effect would be noticeable for ETC. This outcome could result in a 20% hike towards the $88-mark.

Bearish momentum was on the decline, according to the Squeeze MomentumIndicator, but this worked as a hedge against breakdown rather than a price rally. The RSI was being traded at around 40, at press time, and indicated weakness.

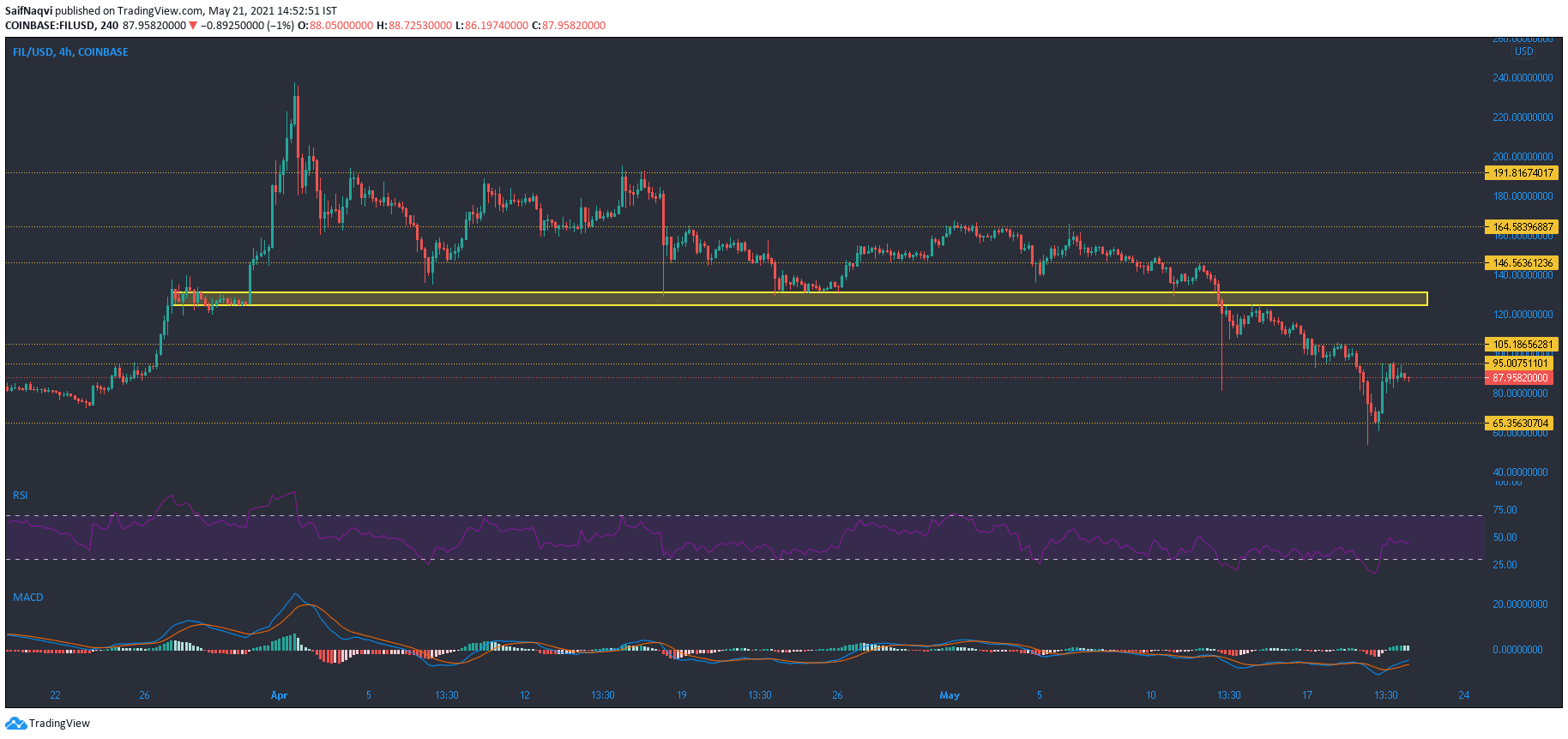

Filecoin [FIL]

Filecoin’s bounce back from the $65.3-support triggered an impressive 42% price hike towards $95, but a breakout was denied by the sellers. However, the state of its technicals was slightly bullish when compared to most alts. The RSI stabilized just below 50, while the MACD line maintained itself above the Signal line.

If the buyers prevail and push FIL above its $10.5-resistance, expect another 17% surge towards the $124.4-resistance. This upper ceiling presented the cut-off point for the bulls but if it is breached, FIL could see gains all the way up to $164.5.

Source: eng.ambcrypto.com